SME D Bank joins hands with Thammasat University to reveal the results of the survey of the SME confidence index for the 1st quarter of 2024. The overall picture has decreased due to concerns about operating results and liquidity tending to decrease. Meanwhile, the forecast for the next 3 months has been increased. From the benefits of the tourism festival and government economic stimulus measures, SME D Bank announced that it is ready to add additional capital to enhance liquidity. Support appropriate cost management Development partners strengthen business Able to seize opportunities to grow to their full potential

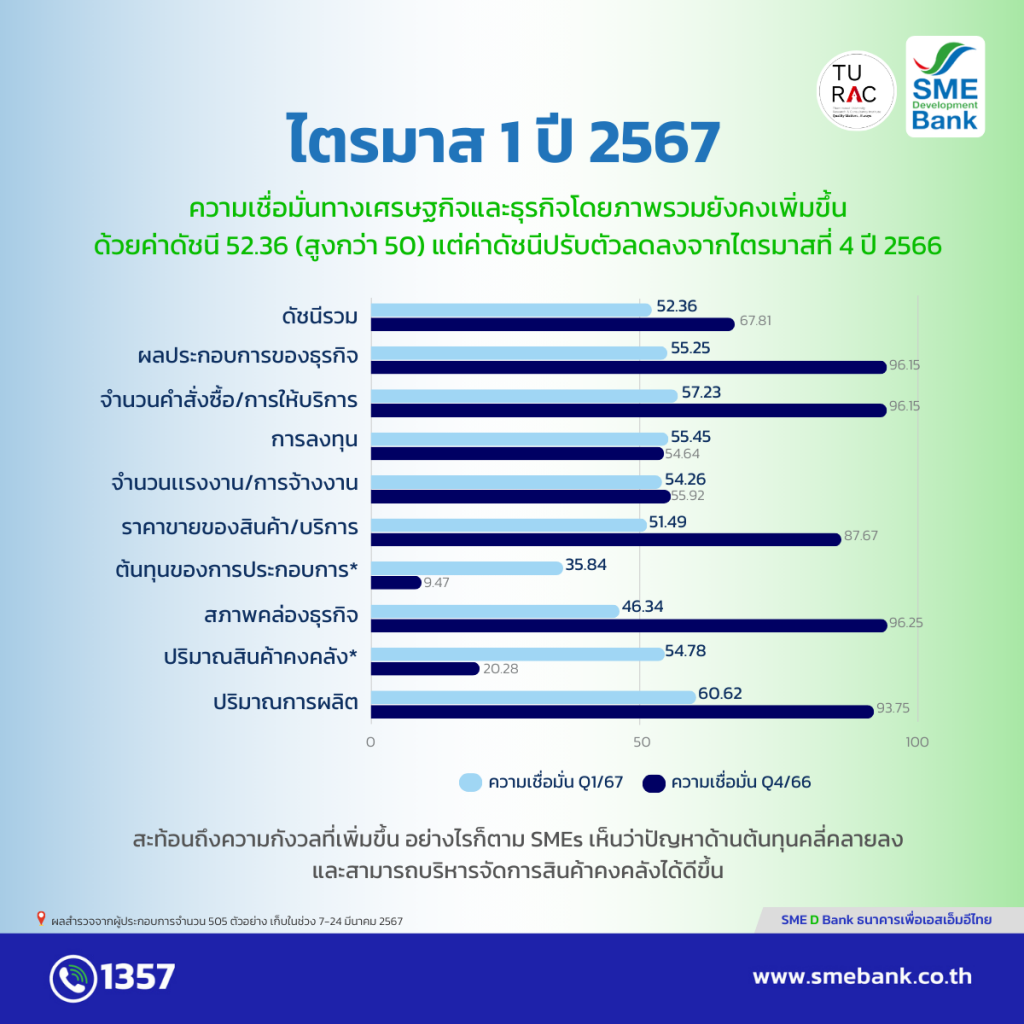

The Small and Medium Enterprise Development Bank of Thailand (SME D Bank) or SME D Bank by the “SME Research and Information Center” and the “Thammasat University Research and Consulting Institute” revealed the results of the survey. “Index of confidence of SME entrepreneurs in the economy and business, quarter 1/2024 and future forecasts” from a survey of SME entrepreneurs nationwide. Covering all types of industries, a total of more than 500 samples, it was found that the overall confidence index in the 1st quarter of 2024 was at the level of 52.36, decreasing from the previous 4th quarter of 2023, which was at the level of 67.81 due to SM entrepreneurs. Rhee is concerned that operating results and liquidity are likely to decline from pressing factors, including unclear government economic stimulus policies. Slowing Thai and global economic conditions and overall purchasing power decreased

When separated into consideration by industry type SMEs in the tourism sector Still have higher confidence than other groups. Because the 1st quarter of 2024 is still an overlapping period between important festivals. This causes continued domestic spending. Approximately 60% agree that operating results will improve. As a result, liquidity, investment, and employment can increase more than any other industry. Meanwhile, the confidence level of construction contractors decreased. and lower than other industries Because there is concern about increased operating costs. including an increase in the minimum wage and energy costs

While forecasting the next 3 months (Q2/2024), SME entrepreneurs’ overall confidence has increased to 57.41 since they will benefit from the continuous tourism season. Domestic consumption has improved and SME entrepreneurs expect to see clarity in the policy and receive stimulus measures.

public sector economy

Mr. Prasit Veerasilp, Acting Managing Director of SME D Bank, concluded that from the results of the said survey. Reflects the increasing concerns of SME operators. and the different confidence of each industry from economic factors that will affect it, such as the construction industry Confidence dropped due to lack of positive factors that would drive the industry. ”This is contrary to the tourism sector which is expected to receive full support. However, to support entrepreneurs in the group who are experiencing liquidity problems. and encourage SME entrepreneurs to seize the opportunity to grow to their full potential. Ready to receive various supporting factors, SME D Bank prepares support guidelines through the process. “Top up capital for development” where the “financial” side has loan products to help reduce the burden Lighten up in installments. Able to manage business costs appropriately, such as the “SME Refinance” loan. The interest rate for the first year is fixed at 2.99% per year and for the first 3 years, the average is 3.50% per year. The maximum loan amount is 50 million baht, installments for up to 15 years, plus no repayments. Principal payment up to 12 months. In addition, “development” services such as Business Matching activities to increase opportunities for SMEs to access new markets, etc., including the “DX by SME D Bank” platform (https://dx.smebank .co.th/) e-Learning system helps increase the potential of SME entrepreneurs. Learn by yourself 24 hours a day.

รับวีดีโอ

ติดต่อเรา

ติดต่อเรา

ช่องทางรับเรื่องร้องเรียน

ช่องทางรับเรื่องร้องเรียน